800-492-6116 Toll-free

insurance.maryland.gov

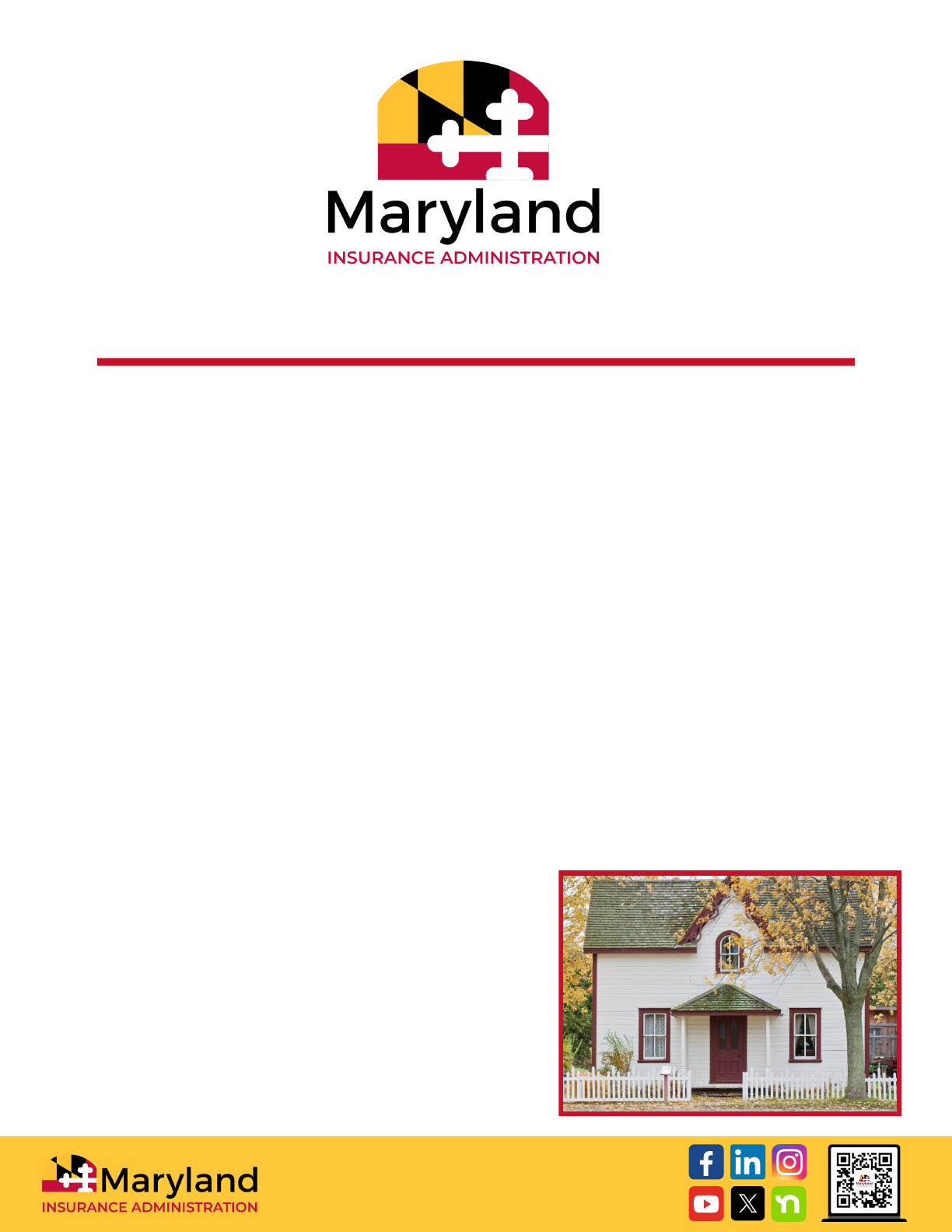

Paying off your mortgage is an exciting event, but with it comes new responsibilities.

When you first purchased your home, if you had a mortgage, you were likely required to

pay extra money each month to an escrow account to pay for your homeowners

insurance and property taxes. Homeowners insurance protected the bank’s financial

interest in your property, as well as your own. But now that your loan is paid off, you are

responsible for making your homeowners insurance payments.

Although you are not legally required to have homeowners insurance, you should think

twice before you cancel your insurance. Your home is likely your largest asset and

homeowners insurance is there to pay for damages covered under the policy.

We often think of homeowners insurance as paying to rebuild after a fire. Think about a

smaller loss, such as a burst pipe or roof damage caused by wind. How much would

these expenses cost you if you didn’t have a homeowners policy? Would you have the

money to repair your home if those losses are in the

tens of thousands of dollars? What would you do and

where would you go if you couldn’t stay in your home

due to a loss?

HOMEOWNERS INSURANCE IS STILL IMPORTANT

EVEN IF YOU HAVE PAID OFF YOUR MORTGAGE

CONSUMER ADVISORY

Shop around! If you have let your insurance lapse,

or you are interested in shopping for a new policy,

comparison shopping is the key to getting the

most out of your insurance dollar.

Contact the Maryland Insurance Administration at:

200 St. Paul Place, Suite 2700

Baltimore, Maryland 21202

410-468-2000 | 800-492-6116 | 800-735-2258 TTY

https://insurance.maryland.gov/Consumer/Pages/FileAComplaint.aspx

You may be surprised at how much less you can pay with another company for the exact

same coverage. Don’t forget, you want an apples-to-apples comparison, so make sure the

quotes you get are for the same coverage.

The Maryland Insurance Administration (MIA) has a great tool for helping you comparison

shop: Homeowners Insurance: A Comparison Guide to Rates. This guide is available on the

MIA’s website: https://insurance.maryland.gov or by calling the MIA at 800-492-6116 to

request a copy. Phone numbers and websites for Maryland authorized insurers are available

in the back of the guide.

The MIA is the independent state agency responsible for regulating the insurance industry

in Maryland. The MIA strives to increase public understanding of the vital role insurance

plays in the daily lives of Maryland residents and businesses.

Though the MIA cannot recommend a particular policy or insurer, Agency staff is available

to help you learn what types of coverage are available and at what cost, as well as to assist

you if you have a complaint about how your insurer handled a claim. For more information

or if you have questions, please contact the MIA at 800-492-6116, or visit

https://insurance.maryland.gov.

This consumer guide should be used for educational purposes only. It is not intended to provide legal advice or opinions regarding coverage under a specific

insurance policy or contract; nor should it be construed as an endorsement of any product, service, person, or organization mentioned in this guide. Please

note that policy terms vary based on the particular insurer and you should contact your insurer or insurance producer (agent or broker) for more information.

This publication has been produced by the Maryland Insurance Administration (MIA) to provide consumers with general information about insurance-related

issues and/or state programs and services. This publication may contain copyrighted material which was used with permission of the copyright owner.

Publication herein does not authorize any use or appropriation of such copyrighted material without consent of the owner. All publications issued by the MIA

are available free of charge on the MIA's website or by request. The publication may be reproduced in its entirety without further permission of the MIA

provided the text and format are not altered or amended in any way, and no fee is assessed for the publication or duplication thereof. The MIA's name and

contact information must remain clearly visible, and no other name, including that of the insurer or insurance producer reproducing the publication, may

appear anywhere in the reproduction. Partial reproductions are not permitted without the prior written consent of the MIA. Persons with disabilities may

request this document in an alternative format. Requests should be submitted in writing to the Director of Communications at the address listed above.

ABOUT THE MARYLAND INSURANCE ADMINISTRATION

The Maryland Insurance Administration (MIA) is the state agency that

regulates the business of insurance in Maryland. If you feel that your

insurer or insurance producer acted improperly, you have the right to

file a complaint. The MIA can investigate complaints that an insurer or

insurance producer has:

Denied or delayed payment of all portions of a claim

Improperly terminated your insurance policy

Raised your insurance premiums without proper notice or in

excess of what the law allows

Made false statements to you in connection with the sale of

insurance or the processing of insurance claims

Overcharged you for services, including premium finance charges

CONTINUED